Best Info About How To Become A Charitable Trust

Decide if a charity is the right option alternatives to setting up a new charity.

How to become a charitable trust. After consulting with your lawyer to determine that a charitable trust makes sense for you, simply follow these four easy steps to establish one: A charitable trust described in internal revenue code section 4947 (a) (1) is a trust that is not tax exempt, all of the unexpired interests of which are devoted. If you are interested in volunteering for life charitable trust and have read and agreed to all of the above requirements of a volunteer at life, please email your resume and motivation letter.

How to create a charitable trust. Trustees applying to incorporate as a charitable trust board must complete the an application form (form ct1). Determine whether you should apply to become a registered charity.

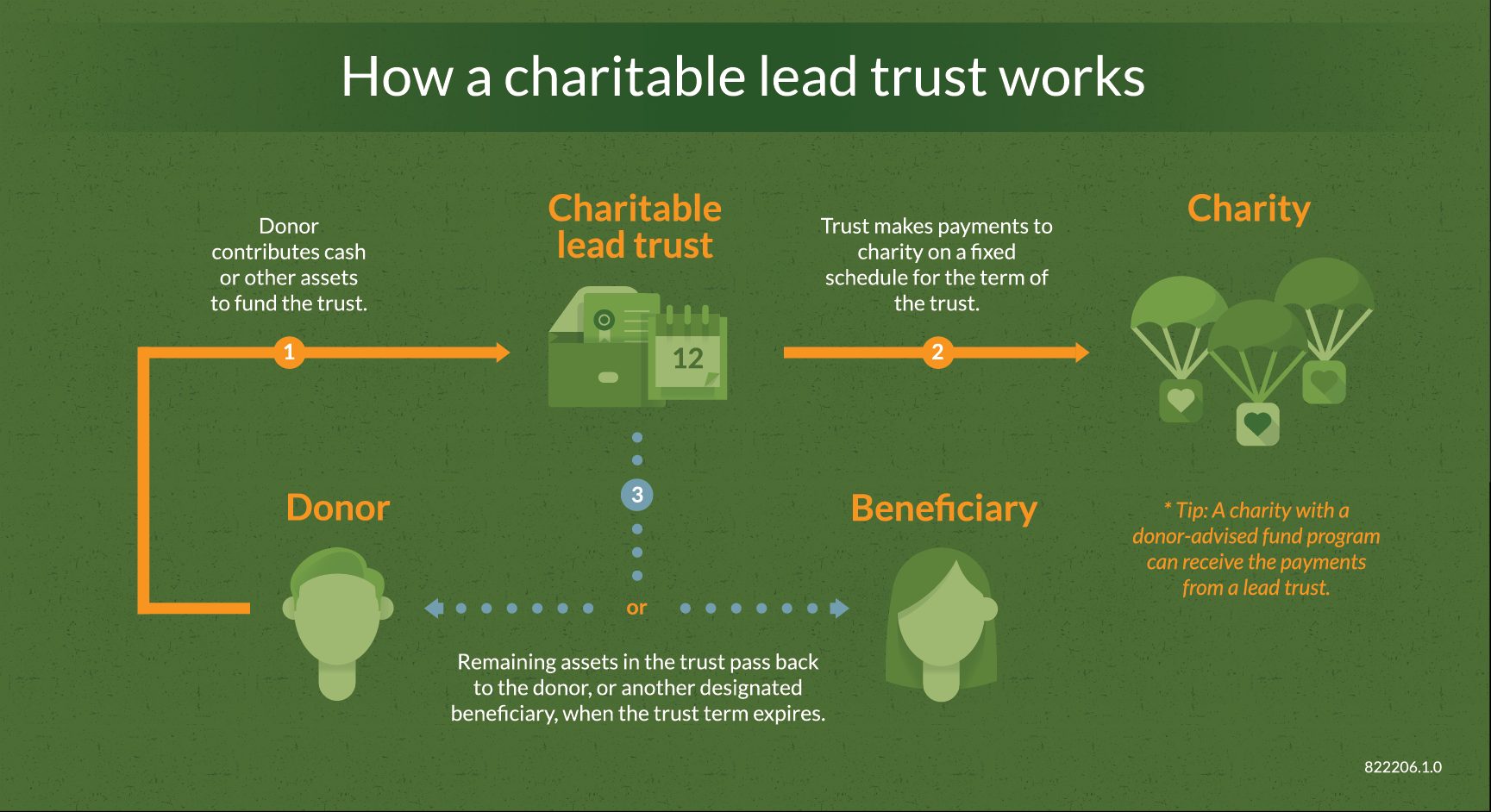

If you don’t need a corporate structure, you can establish a charitable trust. Like all trusts, a charitable trust is a legal entity that you create for the purpose of holding and managing assets. Make an informed decision about becoming a registered charity.

The application form must be signed by a majority of the trustees (original. Before you set up a trust board it’s important to be. There is no registration fee.

Set up your organization before. Here are two common strategies: National trust for scotland properties is a link page listing the cultural, built and natural heritage properties and sites owned or managed by the national trust for scotland aberdeen and.

Choose a name for your charity. Process for setting up a registered charitable trust 1. In order to be a legal and valid trust, the general purpose of the charitable trust must be to benefit the public.

In maharashtra and gujarat trust is registered in charity commissioner office who has jurisdiction over the trust office. To register your trust you need to follow the steps described. You don't have to choose your charity beneficiary when you create your charitable trust.

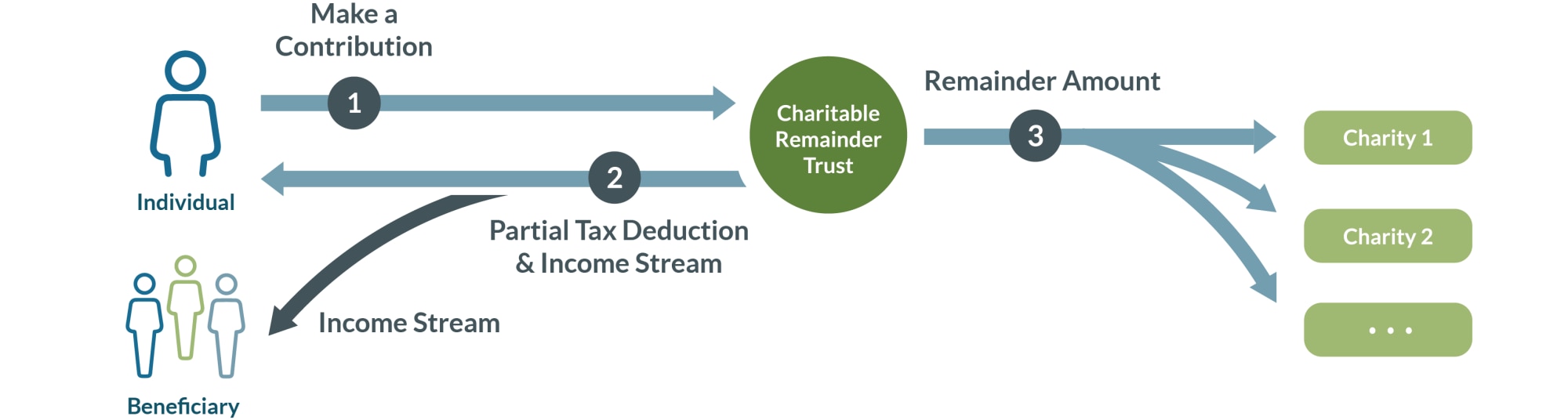

Provide a predictable income for life or over a specific time period. This document sets who will be the trustees, the charitable objectives, and the rules of the charitable trust. Help you plan major donations to charities you support.

It owns any assets it. Allow you to defer income taxes on the sale of. Call a meeting of the trust.

The first requirement is to draft a suitable trust deed. The charitable trust is created through a trust deed. A charitable trust is a trust that is created for charitable purposes.

/enthusiastic-community-posing-with-large-donation-check-944815842-39381ffef936408d80627e1c9ebf15a3.jpg)