Supreme Tips About How To Build Trading System

Developing your own trading system:

How to build trading system. For more such insights,you can follow me on :twitter : Identify the position of the market step 3: Find support and resistance levels step 4:

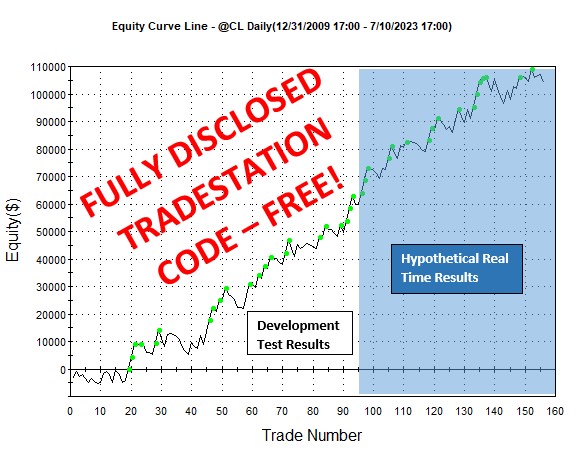

A trading system will therefore outline what types of trades a. Trading as a business training program a total value of $1,997 for only $197.00! Since one of our goals is to identify trends as early as possible, we should use i ndicators that can accomplish this.

Follow these 6 easy steps to ensure greater. Along the way, fitschen touches on exactly what it takes to. The actual form a trading plan takes is entirely up to you.

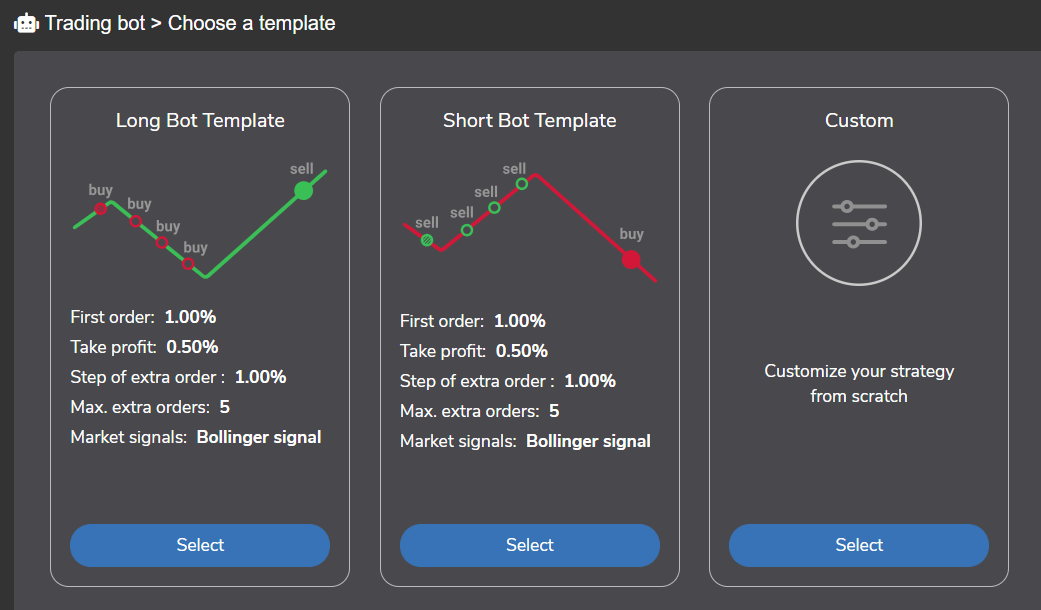

In essence, a trading system is a set of rules or principles that governs a trader’s overall approach to trading financial markets. Setting up your computer can help your trading to have multiple displays. One monitor may be used for trading, another for reading the latest news, and a third for.

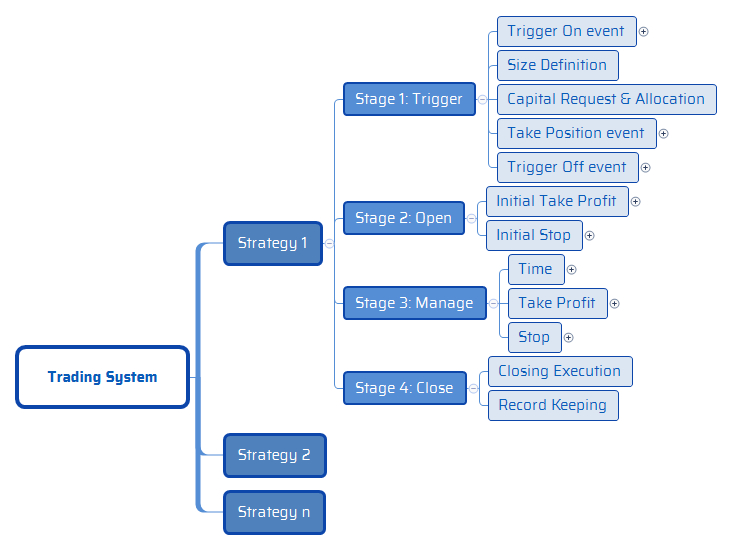

Trading systems will help you find your way through the uncharted waters of systematic trading and show you what it takes to be among those that survive. We define the critical difference between a trading system and a trading strategy. You are going to need an organized.

Learn how to break down and build your trading system. Making my living trading stock options. Formulate your trading plan the very first step would be to make a checklist of the parameters based on which.

In terms of structure, you can think of a trading system as a hierarchical arrangement organizing. Get $10,000 to demo trade create your trading account here. Define your time frame step 2:

Open the data file in excel. A step by step logical guide the basics. Combining a few technical indicators with a buy order and adding trailing stops are not going to make you a profitable trading system.

The automated trading system is also known as a mechanical trading. Send me the expert option trading system: The system described here is built in 6 steps:

The way to stop that and to make tradin. Finance data is almost always going to be displayed in this format of date, time, open, high, low, close, volume (and open interest if futures or options). Like 90% of traders, you probably feel stressed out, frustrated or trading just feels like a huge challenge everyday.

:max_bytes(150000):strip_icc()/dotdash_Fina_Pick_the_Right_Algorithmic_Trading_Software_Feb_2020-01-e58558a7c8f14325ab0edc2a7005ab68.jpg)

/dotdash_Fina_Pick_the_Right_Algorithmic_Trading_Software_Feb_2020-01-e58558a7c8f14325ab0edc2a7005ab68.jpg)

![How To Build A Stock Trading System For Your Life [Infographic]](https://infographicjournal.com/wp-content/uploads/2020/11/Build-a-Stock-Trading-System-feat.png)

:max_bytes(150000):strip_icc()/BuildaProfitableTradingModelIn7EasySteps2-93ba242cb2e3443a8a846ed36c92867f.png)