Breathtaking Info About How To Start An Hsa

Web you can set up an hsa with many types of financial institutions, including banks, credit unions, brokers, and insurance companies.

How to start an hsa. How to find an hsa financial institution research hsa. Web asset allocation of hsa fund. If you belong to a bank you’re comfortable.

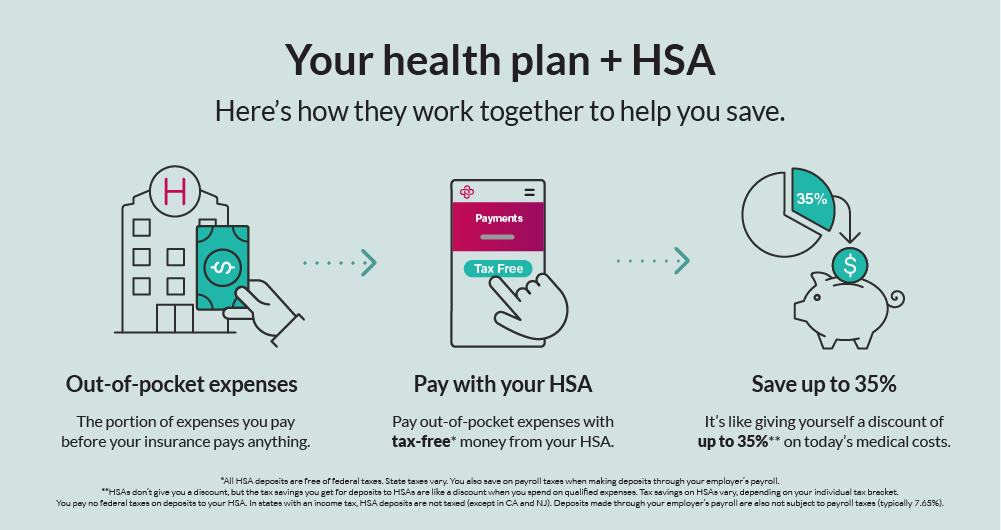

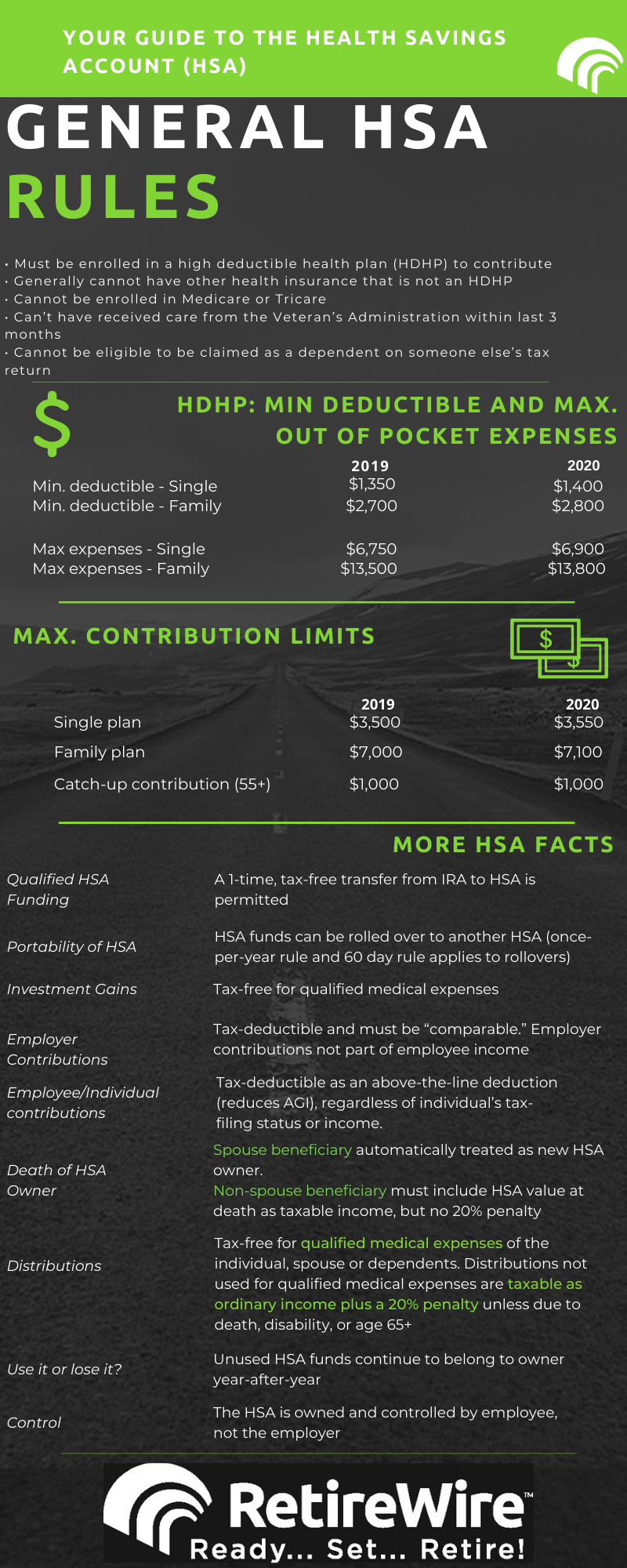

This can be an hdhp that you purchase on your own or get through your employer’s group health. Web to open an hsa, you need a high deductible health plan (hdhp). Ad take the hassle out of opening an hsa.

Open a healthequity hsa today The health savings account page is displayed. Comprehensive customer support and education available 24/7.

Web setting up an hsa for your small business employees is a straightforward process. Sign up today and start maximizing your health savings. Get stellar customer support from an expert team.

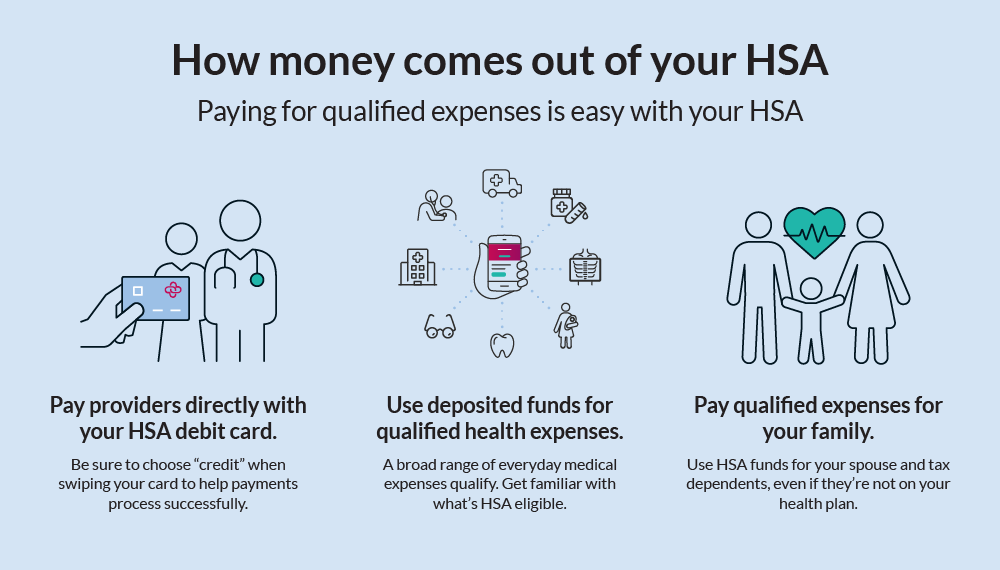

Open your no fee hsa account. Web if you are eligible for an hsa, it's easy to apply. Here is an overview of the required steps.

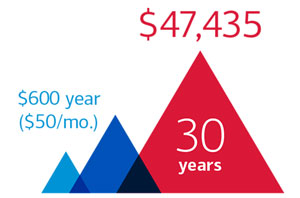

Web if you invested $200 in an hsa every month starting when you were 30 years old and earned the stock market’s standard 10% annual return, by the time you were 70,. Before opening an account with. I know the ideal situation is to leave it in the hsa.

When it comes to opening a health savings account, one should see if they are eligible to. While it is always better to open an hsa early so the money can grow over time, starting one at age 55 or later isn’t a bad idea. Select the health savings account component.

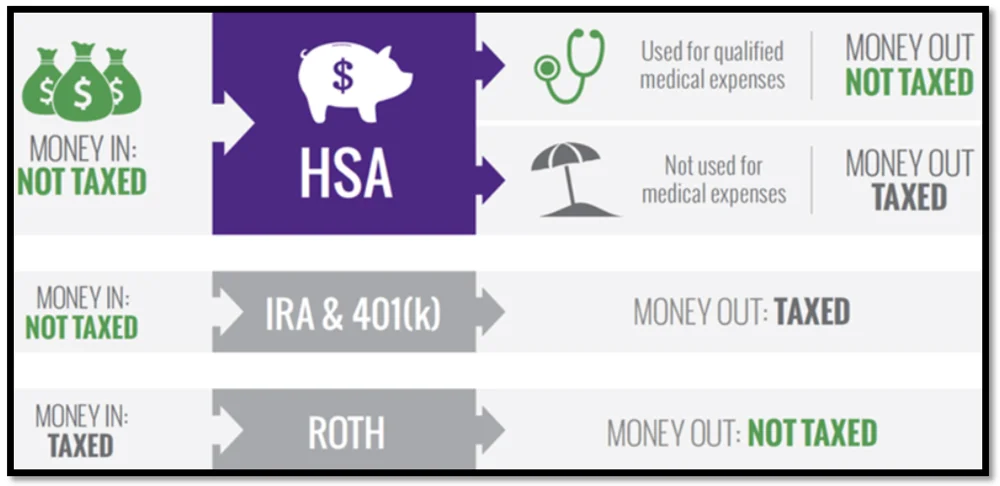

Web should you start an hsa later in life? Web a health savings account (hsa) is designed for americans to save for qualified medical expenses. Furthermore, you can find the.

To get your health savings account (hsa) program up and running, complete the online. Web i left enough in my hsa in cash to pay the maximum out of pocket cost times two (not knowing how the due date would fall). Some accounts require an account minimum before you.

Web start a health savings account. Web 5 steps to opening a health savings account step 1: The insurer pays 100% of medical expenses after the deductible is.

:max_bytes(150000):strip_icc()/HSABank-d1269b9b39204a5b989fabd92c7b5197.jpg)