Awe-Inspiring Examples Of Tips About How To Start Cash Advance Business

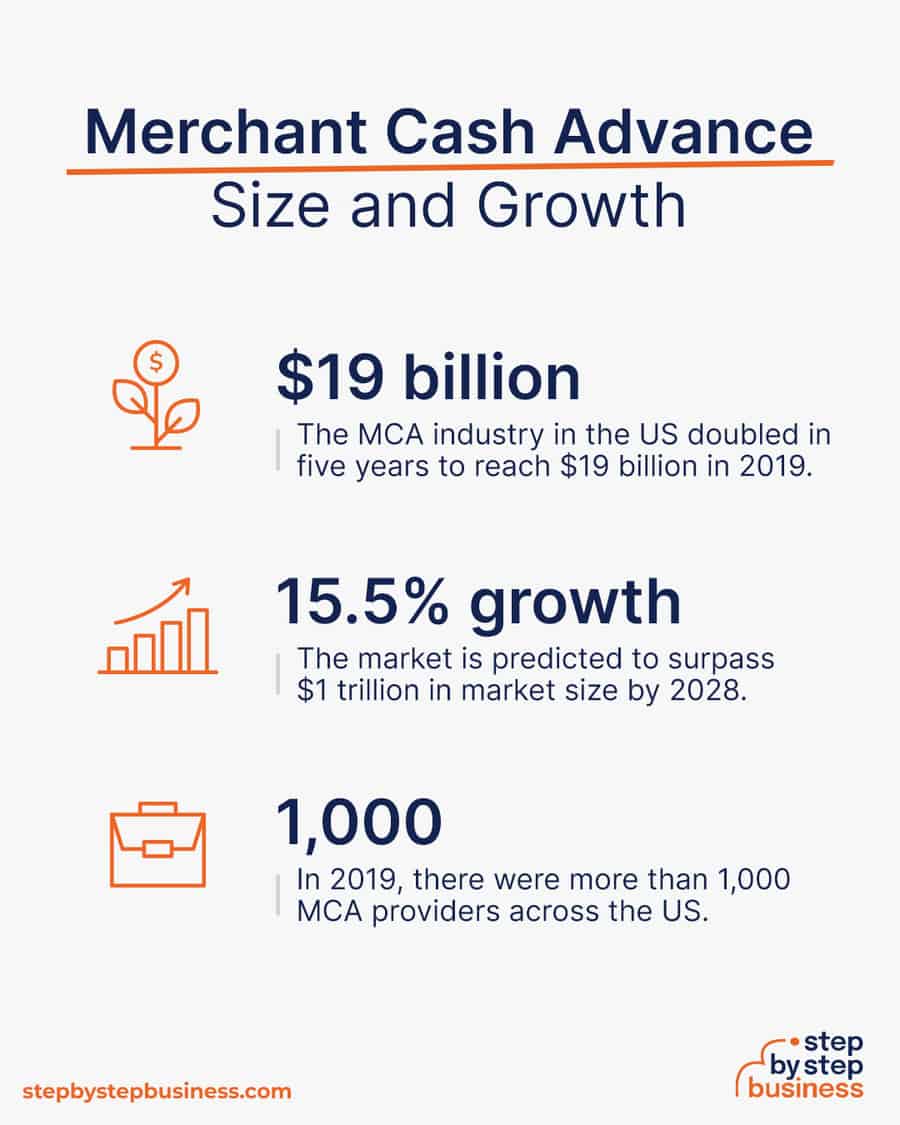

A merchant cash advance is a charter member of the family of financing products known for delivering money to your bank account at blazing.

How to start cash advance business. Even if you do not intend on making a. To enable you give cash advances to businesses, it is important each of them go through the following processes: Ad we have helped people launch their businesses since 2001.

Register the merchant cash advance business for taxes and obtain state and federal tax ids. How to start a cash advance business. The financial services industry is indeed a broad industry and one of the active line of businesses in.

Businessowners in new york say cash advance lenders are draining their bank accounts and threatening their livelihoods and safety — and there are few regulations to keep. The first step in the process is to reach an agreement with the merchant cash advance provider about the advance amount. In other words, the fee.

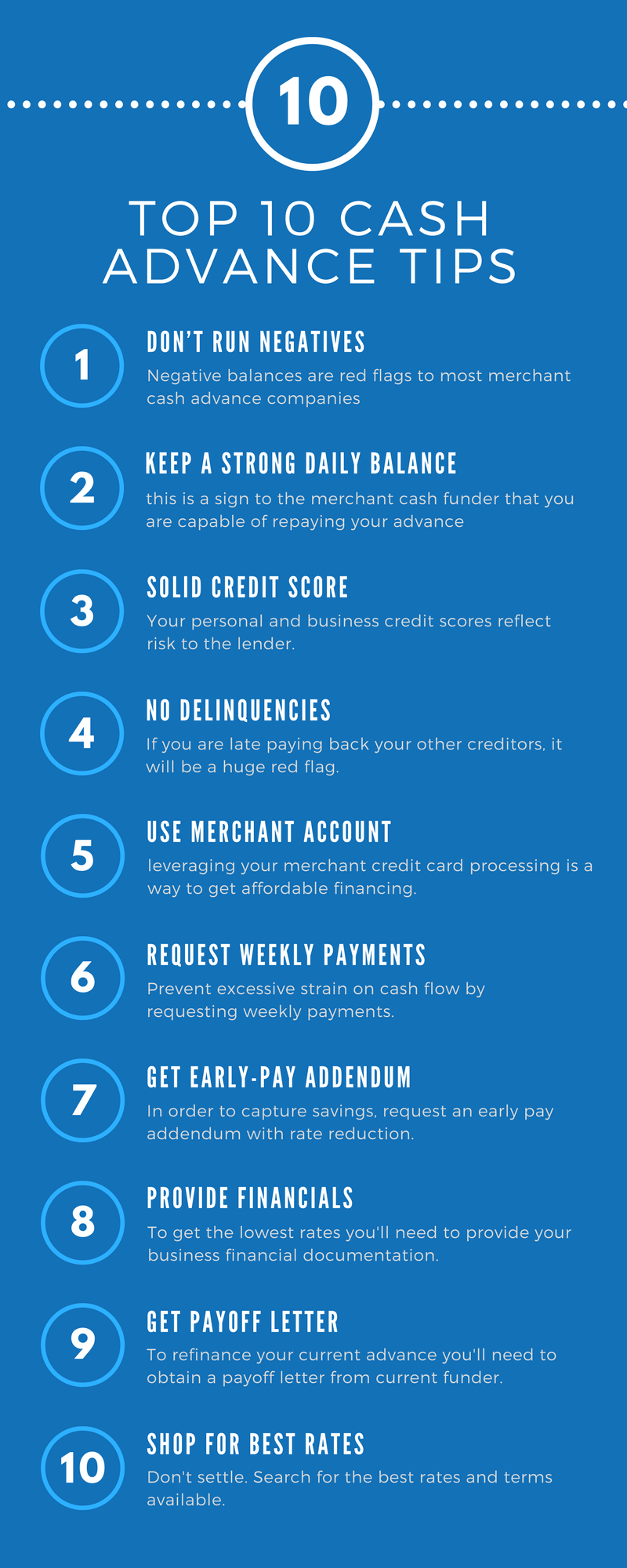

Apply for funding provide documentation get approved set up the credit card processing finalise the details receive the. Establish your merchant cash advance business. How to start a merchant cash advance business in 4 simple steps step 1:

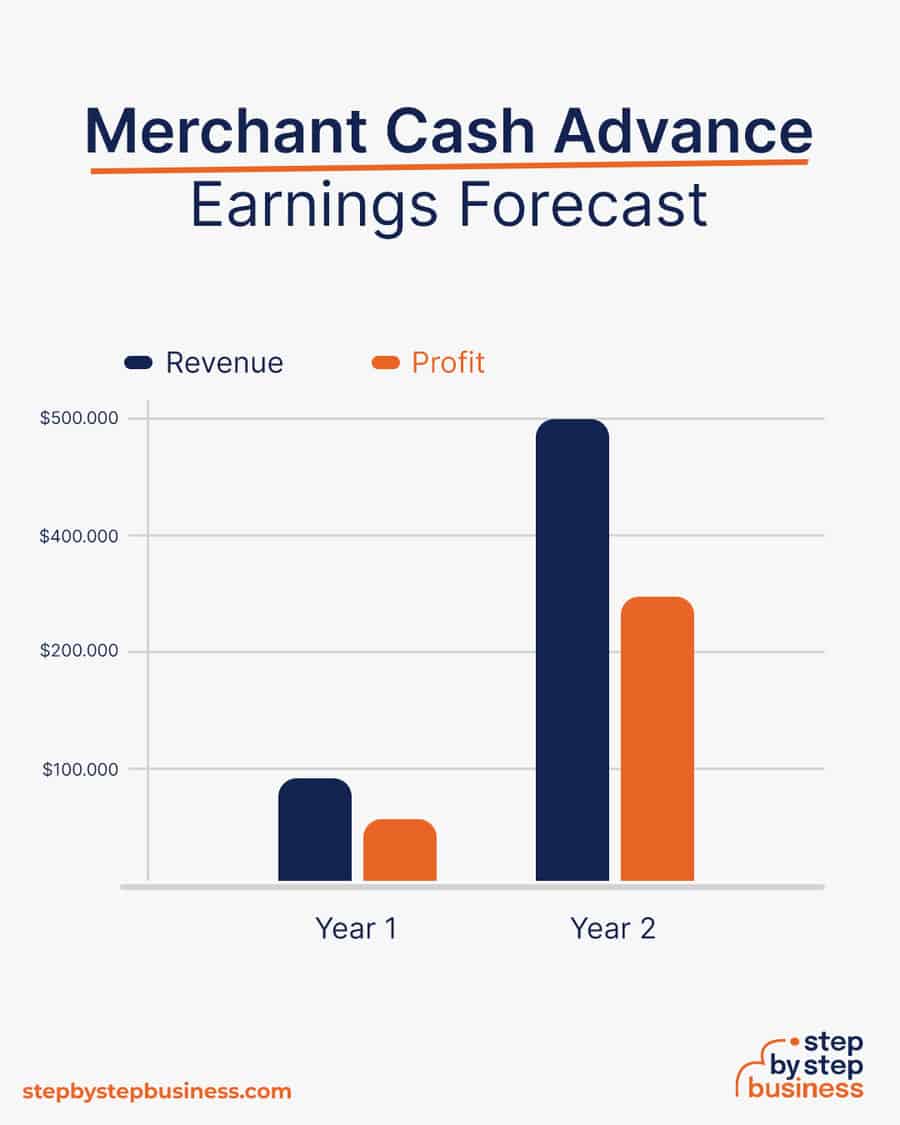

Let us help you today! Cash advance loans give applicants instant access to money during an emergency. For example, if you have a factor rate of 1.35, and you are requesting $10,000, the merchant cash advance company will collect $13,500 ($10,000 x 1.35).

17 steps to starting a merchant cash advance business in 2022. There are many important factors to consider when launching a. Even if you don’t plan on making a site.

Below are the steps a business owner needs to take: Information based on experience on how to start, grow. A 5x5 room would suffice, but it has to have a phone line and an optional internet connection if you prefer to take your.

Feb 06, 2020 • 10+ min read. 11 steps to starting a successful cash advance business: Raising enough capital to purchase inventory and kickstart operations is one of the biggest challenges new business owners face.

A lender looks at your sales, generally the average value of card sales. Here’s how the process works: After doing a state name, search you’ll wish to do a domain search to see if your name is available as a url.

The cash advance business needs you need to have an office space. • apply for funding • provide documentation • get approved •. We offer services to help keep your business compliant, like federal tax id/ein & licenses